Consumer Behavior Trends: Spending Habits in 2022

Published on May 05, 2022

Soaring gas prices, record-breaking rental rates, and surging food costs are just a few of today’s economic challenges taking their toll on consumers. And more financially conscientious customers mean brands have to do more to earn their business.

To get a better understanding of how the economy is impacting their spending habits, we connected with more than 11,000 consumers in the U.S. Our research uncovered top consumer behavior trends—including where consumers are planning to cut back, what factors are informing their purchase decisions, and how industries can best prepare to meet customers’ evolved needs.

Most consumers have concerns about their future financial situations

Disruptions in the supply chain and other global events continue to impact the consumer price index (CPI)—causing the cost of everyday items to surge. Today, the CPI is the highest it’s been since 1981.

And while we’re seeing an increase in wages across the country—after years of remaining flat—inflation is negating much of those gains. In fact, when adjusting to the cost of living, wages were actually down 1.3% in the last month.

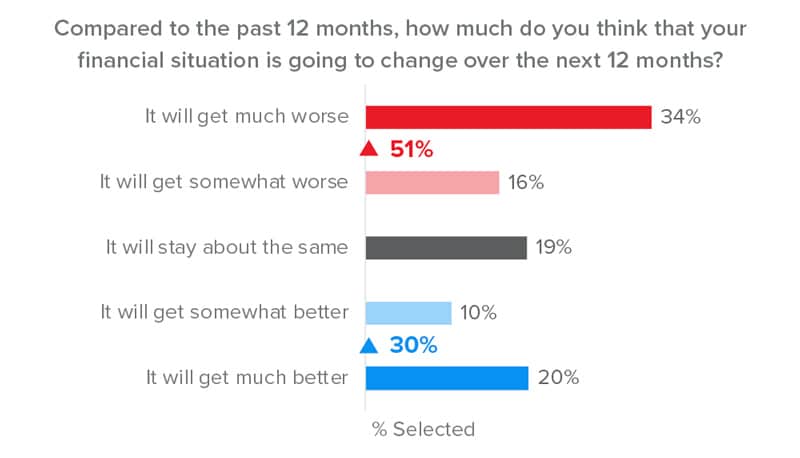

With these economic challenges, more than half of our panelists believe their finances will take a hit over the next year. While this varies slightly across industries, 1 in 3 retail consumers are predicting a turn for the worse—resulting in a shift in priorities that will put more of an emphasis on essentials, like groceries, and less on non-essential retail spending.

Demographic factors also have an impact on consumers’ perceptions of their financial future. Our research shows retired, more affluent (an income of $75k or more), or part-time employed consumers are the most worried about how the future will impact their finances.

Improve the retail experience with these essential steps

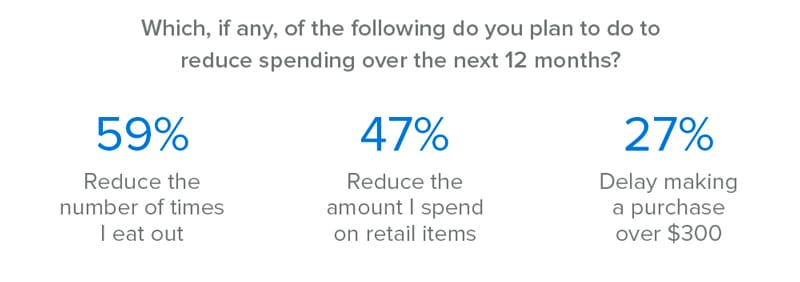

Consumers are planning to spend less at restaurants and non-essential retailers

To adjust to changes in their personal finances, many consumers plan to eat at restaurants less and do less shopping at non-essential retailers. In fact, nearly half said they’ve already done less shopping at non-essential retailers in the past year.

Additionally, businesses in the entertainment and travel industries could also feel an impact, with more than 30% of consumers saying they will spend less in these areas as well.

On the other hand, almost 1 in 3 panelists say they will increase spending on groceries. This is likely due to two factors: 1) If consumers are ordering food from restaurants less, they’ll be cooking at home more and 2) Consumers are likely considering inflation’s impact on rising food costs.

When we look at which consumers are scaling back costs, consumers with lower household incomes ($55k or less) are most likely to cut back on spending at restaurants and non-essential retailers.

Though consumer behavior trends are showing fewer customers ordering food from restaurants and not shopping as much, it’s important for brands to continue prioritizing their digital efforts. Convenience options that gained popularity during the pandemic—such as third-party delivery, curbside pick-up, online shopping, and contactless in-store visits—are likely to stick around for good.

Brands should take the time to assess their third-party delivery strategies and provide options that satisfy customers’ craving for convenience—taking the necessary precautions to safeguard against potential pitfalls and not lose control of the customer experience.

Consumers are prioritizing their savings—but also travel plans

With financial concerns on the rise, it’s not a big surprise many consumers are choosing to prioritize their savings over the next year to build up a nest egg should things get really rough. But with the combination of waning pandemic-related restrictions and restless people tired of being at home, taking a vacation is also a priority for some consumers.

We previously mentioned the travel industry is one area where many consumers are planning to spend less. But our research also shows almost 1 in 4 are planning to spend more on travel in the next 12 months.

Knowing this consumer behavior trend, retail and service brands could focus promotional campaigns on products conducive to vacation preparations. Reward loyalty program members with a free pair of sunglasses with their next in-app purchase. Throw in a free car wash with their next oil change. Run a BOGO promotion on luggage. Anything to show your customers you value their business. Speaking of value…

Across all industries, consumers have lower Value satisfaction

With a heightened focus on personal finances comes a more discerning look at value—even the most laid-back consumer can probably say which gas station in town has the cheapest gas right now. Today’s consumers are expecting more bang for their buck, and brands across industries need to give their value offering a hard look.

Unfortunately, Overall Value among retail concepts had declined by 2-ppts over the last 6 months (when compared to the previous 6 months). We’re also seeing a rise in visit share with brands like Dollar General and Walmart—which historically lines up with times of economic hardship when value is top of mind for consumers.

The important thing to remember here though is higher value doesn’t always mean less expensive. Though nearly half of retail consumers list Promotions or Deals as a top factor in choosing a brand, 64% stated Quality of Products as most important.

Additionally, for grocery and service consumers, a previous positive experience is also a big factor. Which mean brands offering a differentiated experience—with high-quality products and exceptional customer service—will win customer loyalty in the midst of these economic challenges.

Stay on top of consumer behavior trends with a sound customer experience strategy

The unprecedented ups and downs of the past two years have made it difficult to prepare or predict what’s coming next. But we do know the most effective way to weather the storm is to leverage the direct feedback of employees and customers. Brands that can adapt their customer experience management strategies to meet changing needs and expectations will be the ones to come out on top.

Related articles

Driving Brand Loyalty for Restaurants through Value-Focused Offerings

Consumers are cutting back on spending and “value” has become the name of the game—especially for the restaurant industry, which is taking one of the biggest hits. A recent SMG study showed nearly 70%

Adapting Your Customer Experience for the Digital Age

From restaurant and retail to c-store, healthcare, and every industry in between, it’s rare to find a customer experience that isn’t touched by technology. And this digital omnipresence means brands t

Getting Experience Data to Stay Customer Centric with Contactless Service

As of last June, 81% of Americans owned a smartphone. In the throes of this convenience revolution—as more consumers turn to their phones for research and to make purchases—the pressure for brands to